The last few years have been, as the saying goes, ‘interesting times’. We have had a global pandemic, global supply chain failures, surging costs and rising inflation, an uncertain geopolitical environment, the ongoing climate crisis, a series of bank failures, and potentially a recession coming.

The list of tactical challenges any global treasurer faces is long, so for today I’d like to break down the strategic challenges into five distinct categories, leading from that risk mitigation foundation to the ideal of advanced treasury operations.

1. Manage Risk in Changing External Environment

One of the first things to do is actively pay attention to external risks. What’s changed in the macro environment? What is urgent and can cause an existential risk to your business?

The economic reaction to those ‘interesting times’ has been an environment of sustained interest rate rises, which has exposed both banks and companies. Moreover, this quick raising of interest rates has led to an inverted yield curve that has revealed many banks’ poor risk management strategies.

What happened in the US earlier this year was a shock to a lot of corporate treasurers. We saw that the response from many banks and financial institutions, in the face of economic turmoil, was to try to change the reality to fit their model rather than their model to reality.

Market events like the Silicon Valley and Signature Bank collapse, and the difficulties seen by Credit Suisse, have led to significantly increased volatility in the financial markets.

This management of ongoing risk is the core function of any treasurer, but there are good and bad ways to do it. For instance, at TransferMate, we don’t lend against our funds; they are fully segregated and safeguarded. This is a model in opposition to banks like Silicon Valley and is more sustainable and reliable in the long run.

2. Addressing Impactful Internal Risks

The second challenge is ensuring you have the proper controls in place from a process and access perspective to monitor how your money moves across your network.

Cyber, for example, is an area where risks can escalate over the coming years. In a report published on March 27th, 2023, Europol issued a stark warning against generative artificial intelligence, such as ChatGPT, and its potential to help criminals get better at defrauding people and spreading disinformation. Protecting yourself from phishing scams, for example, will get more complicated with the rise of AI, which will help create highly targeted attacks on employees and businesses.

You need to arm your finance team with a B2B payment fraud prevention platform to ensure your company pays the right third party on the right bank account.

You need to protect your company from internal risks such as access controls (two-factor Authentication and dual authorization), have Certification ISO 27001, limits in place, enhanced focus on larger amounts, etc. Treasurers are often the custodian of enterprise risk management and need to know where the funds are and ensure they are well safeguarded.

3. From Risk Management to Foundational Treasury

Managing internal and external risks are urgent priorities, but what is the next step beyond that? I’d argue that cash optimization is the ‘north star’ of what to focus on next, as it aligns so many of the challenges into a single goal.

Cash optimization is to be measured carefully by treasurers - not so much accounting-type measures, such as the cash flow statement or the profit-and-loss statement - but discipline around how cash is moving through your organization. Knowing your cash positions and forecasting short and medium-term will help you know that you can optimize your cash. From a receivable perspective, it is key to know how much money you will collect, which will help you plan the payment of your invoices.

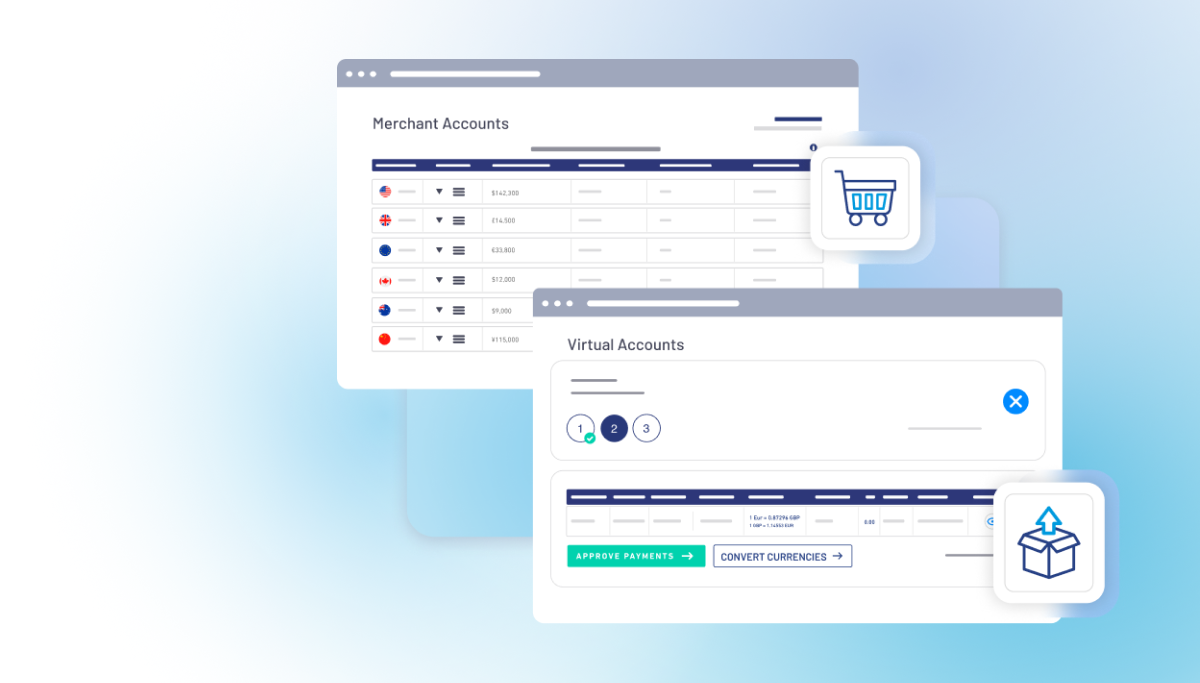

TransferMate has the ability, via its e-money licenses, to hold funds in over 30 currencies (with accounts having addressable BIC and IBANs). We can issue local virtual accounts, for example, GBP accounts domiciled in the UK, SGD accounts domiciled in Singapore, etc.

Treasurers can use the global accounts to receive, hold and pay locally as if they were domiciled in those countries. FX conversion and repatriation of funds to Corporate HQ can occur at a time of the Treasury’s choosing for maximum flexibility while reducing the time it takes to transfer money internationally.

4. Moving from Foundational to Optimized Treasury Operations

Strategic planning must include measured outcomes and measurement of trends. The first step to achieving that is to get accurate, up-to-date, and relevant data.

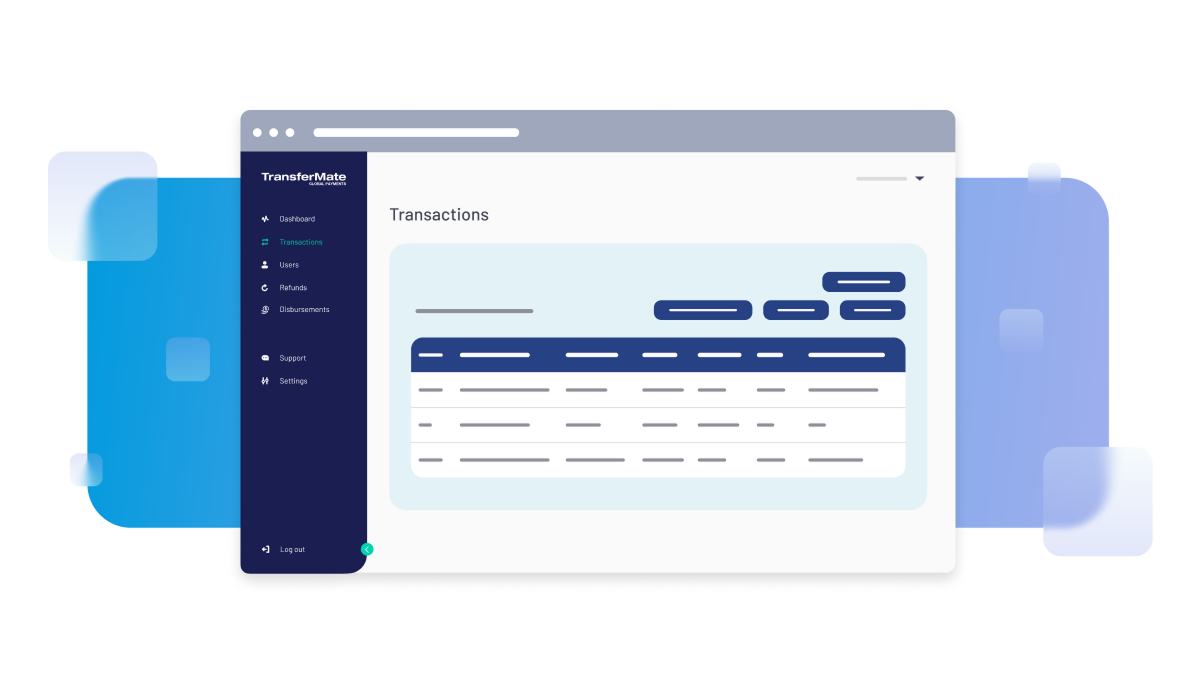

By having Treasury Risk Management Systems such as SAP, FIS, or Kyriba, treasurers need to have both operational and strategic dashboards.

Operational dashboards will help you manage your day-to-day treasury operations. But every week, every month, how do you track whether you have met your treasury objectives? For instance, the reduction of cash from 45 days to 25 on account receivables.

New types of software can produce this data, especially when compared to traditional methods. Previously, treasurers would have to use multiple banks and platforms to process all their payables and receivables (from supply chains to payroll) and then reconcile all that data independently. Now, single platforms and API integrations across platforms can either significantly reduce that manual workload or eliminate it entirely.

5. Advanced Treasury

The day when one single ERP was managing everything is over, and nowadays, corporate treasurers can benefit from having a wider range of platforms doing niche jobs because of the advanced technology.

As treasurers, you will have more choices and more vendors. For instance, a company can choose Kyriba for Treasury Management, Coupa for Accounts Payable, and High Radius for Accounts Receivables, and all these platforms will plug into your ERP with an API interface instantly, whereas before, it could take several years just to implement one ERP.

Today there are payment rails used such as SWIFT, RTGS, ACH, and Instant. At TransferMate, by using ACH, Dom Wire, and Instant local rails, you eliminate lifting fees and wire fees. Once you are onboarded, treasurers can immediately access all those virtual accounts and pay in 141 currencies, including the exotic ones.

There are different rules with different schemes, but when it comes to protecting your funds, treasurers should investigate players like GIACT in the US, which has a team of experts specialized in risk and security, creating and delivering innovative technology solutions to protect companies and their customers from payments and identity fraud.

Having such controls in place will prevent you from invoice or beneficiary fraud. It is critical to have controls operating 24 hours a day, take advantage of the advanced technologies, optimize your payouts/receivables structures by not using intermediaries, paying your suppliers by choosing local rails not to get hit by wire fees.

Finally, as the environment changes so much, stay paranoid and ensure that you know you are dealing with the correct suppliers; keep the focus on risk because the way that things are changing means that you need to have flexibility. Ensure your banks, financial institutions are fully regulated and funds are segregated and safeguarded.

Inertia is the enemy of innovation

The advancements made in how treasurers can operate in the last half-decade have been significant, but it does require a deep-breath moment and the ability to carve out time to implement those advancements in your own operations.

We live in interesting times, so let’s be interested in the solutions that allow us to thrive in them.

A shorter version of this article appeared in ATEL magazine, issue 110. For more on how TransferMate can help treasury officials, contact the team today.