Competitors or collaborators? Friends or foes?

The fintech and traditional banking sector are often portrayed as pure competitors, with fintech’s trying to supplant traditional banks and create a new financial ecosystem for consumers and businesses. The reality, though, is much more nuanced, with collaboration as common a feature as competition.

We sat down with Gary Conroy, Chief Product Officer at TransferMate, and talked about where the real differences lie, the collaborations already happening, and the next step in the relationship.

1. The Traditional Correspondent Banking System and the Fintech Alternative

Q. We’re talking today about the convergence of the traditional banking system and fintech. So, let’s get some fundamentals in place – what is the traditional correspondence banking system?

I think everyone knows the traditional banks – what you’d know as high street or commercial banks – that provide transactional services, as well as credit, mortgages, overdrafts, etc., to retail customers, from individuals to businesses and everything in between and beyond.

At its base, it’s a vast (and complicated) network that allows people and businesses to move money from point A to point B.

Q. The term ‘Fintech’s’ obviously is a broad term, so where does TransferMate fit into that sector?

You’re right, ‘fintech’ can describe a broad range of ideas, but generally fintech’s are transforming how businesses pay by building new banking infrastructure for them to leverage.

At TransferMate, our payments infrastructure is the largest non-bank network in the world, and the third largest even when you include those banks who have gone down the route of building a proprietary global financial network.

Basically, we have built new bank rails – payments infrastructure as a service at a global scale. We’ve done this by securing regulatory licenses across the globe, which in turns gives us access to local payment schemes across the world, and we’re able to integrate that in a simple interface for our customers to use.

Q. What’s the outcome of that new payment’s infrastructure?

Well, it’s important first to look at what we’re replacing. With the banking infrastructure, there is a lot of complexity – and unnecessary complexity at that. It’s made up of a vast network of connections; lots of integration points with multiple parties that has been built up over centuries.

I see the job of fintech’s as being able to abstract that complexity away.

The outcome is quicker, more transparent, and more cost-effective payments for users of that new infrastructure; and those users can range from direct customer to banks and FIs that partner with us and leverage it for themselves.

Q. How else does this new infrastructure change things?

It's not just about the faster payment rails, but on top of that you can layer open banking, account information services, payment initiation services. You can have confirmation of payee. You can have a request to pay.

"We want to bring the same experience to business and corporate and finance users in their professional life that they're used to in their everyday consumer life."

So, there's all these different value-add that you layer on top of that technology that, ultimately, allows for an easier end user experience. And one of the interesting challenges for TransferMate is that consumers are used to a relatively easy user experience in their daily consumer life.

We want to bring the same experience to business and corporate and finance users in their professional life that they're used to in their everyday consumer life.

2. Licenses, regulations, and security

Q. A key part of that infrastructure is licences and regulations. How have fintech’s got permission from all these countries to operate there? Presumably there's a lot of hoops to jump through to establish a banking presence in a country and to be able to move money in and out of it.

Absolutely. First thing to say though is that not all fintech’s are regulated, nor do all fintech’s need to be regulated.

In TransferMate, we went down the regulated route. We could've gone down a sponsor bank route and use sponsor banks and their licenses, and just provided the technology, but we believe there's value in having the regulation. It shows a maturity of capability.

We have access to over 140 currencies and 200 countries. That, in turn, gives banks access to local low-value rails, be that ACH, be that instant, as well as domestic and international wire.

And certainly, as a regulated payments institution, we have both payments institution, money transmitter, and e-money licenses.

You are subject to, effectively, the same scrutiny that any organization, including banks.

Q. If a bank partners with us, do they get automatic access to those regulated regions where we've done the legwork?

Yes. We're allowed to operate in those regions where we're licensed. So, if anyone - either a bank, be they regulated, or a software platform partner or a customer - wants to work with TransferMate, we're operating under our own license in those territories.

We have access to over 140 currencies and 200 countries. That, in turn, gives banks access to local low-value rails, be that ACH, be that instant, as well as domestic and international wire.

For the banks, who may be dealing with 20 or so of those intermediaries (which is, by the way, also very expensive to maintain all those bilateral relationships), this significantly consolidates down that number. They’ll have access into those territories they don’t have reach into today and, in doing so, will substantially reduce their costs.

Q. One thing you would associate to banking network is the security behind it. Does the infrastructure built by the fintech community have those same robust systems? Where do they differ?

I can't speak for the fintech community, but I can speak for TransferMate.

We've implemented very robust systems. With all different regulators - we've taken the highest bar of all of those and made sure that all our anti-money laundering and transaction screening goes through the most stringent of processes.

Our job is, I believe, not just to comply with regulation, but to go above and beyond to ensure that we're doing everything we can to ensure the integrity of the financial and payment systems.

3. Current collaborations between banks, FIs and fintech’s, and next steps

Q. Can you give me an example of a current collaboration between a bank and a fintech like TransferMate?

One of the more interesting ones is our partnership with Wells Fargo as a distribution partner. So, we have a receivables request-to-pay product that operates across borders and currencies. And we have white-labeled a branded version of that, which we call ‘Global Invoice Connect’, with Wells Fargo.

Their treasury management solution consultants in accounts receivable salespeople are then armed with that tool in the market to go out and sell that to their customers. In that case, the bank really needs to create nothing of their own. We've integrated with their systems to provide one data set for all receivables for those Wells Fargo customers. But it gives them another tool in their arsenal to go out and sell as a distribution partner.

Q. What are the next steps when it comes to collaboration between banks and fintech’s?

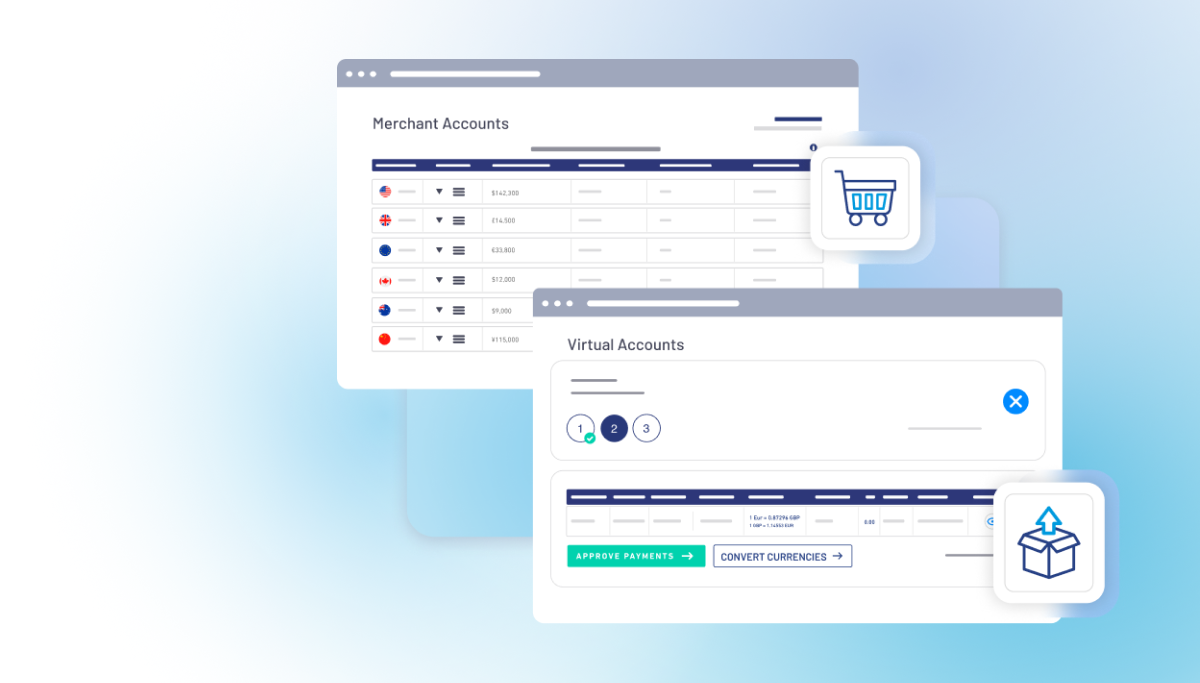

So, in TransferMate we've recently launched TransferMate Connect for banks and FIs, where we can effectively provide access to local low value clearing schemes at a global scale, thus adding capability for banks and FIs.

We believe this is a true game changer.

Through TransferMate Connect, banks and financial institutions will be able to build new cost-effective, fast, and secure payment propositions, allow their clients to set up trading capabilities in new territories quickly and at low-cost, and create or expand revenue streams generated by the funds moving through the network.

The technology allows us to talk to the bank or FI directly to onboard their clients, without us ever having to contact the end users directly. They can put out new or improved products into the market without causing friction for their clients.

Q. What will TransferMate Connect look like in practice?

We’re initially offering clients the ability to settle in around 80 currencies once onboarded (rolled out in phases), with multiple client models available to expand that ability to all 140+ currencies covered by our network.

A unique part of the proposition is the ability of banks and financial institutions to also integrate with another TransferMate product, Global Accounts, and again give their clients the capacity to leverage it for their own benefit.

Global Accounts allows users to open local bank accounts in 29 currencies (with more coming soon), creating their own international banking network where they can hold, pay, and store currencies in a way that suits them. It significantly reduces transaction fees and FX costs for users, allows for better control over international cash flows, and exponentially speeds up the ability of a user to set-up a banking presence in a new territory.

This is a complete package, and its scope is unrivalled in the marketplace. We’re already working closely with several partners to integrate TransferMate Connect into their offering, and then it’s a matter of continuously growing and improving that complete package.

Q. It really is a case of collaboration beating out competition, isn’t it?

Exactly. The days of competition are long gone. I see a similarity in the AI debate going on right now about ChatGPT and the like replacing jobs. I heard a nice line that said ‘AI won’t replace workers, it’ll replace workers who don’t use AI’.

I see the same in the relationship between fintech’s, banks and FIs – it’s the ones who put in the effort to collaborate who’ll thrive.

Gary, thank you very much.

If you're a bank or FI and want to know how partnering with TransferMate can benefit you, get in touch with the team today.

.jpg)